|

Optimal Pricing Through Value Modeling

David Feldman

John Wurst, Ph.D. Printed in The Journal of Professional Pricing

2nd Quarter 2001

Value-Based Pricing

Of all the strategic decisions faced by a firm, none is more important than the setting of prices for the various product and service offerings. Pricing has been studied throughout history, and yet many of the traditional pricing methods remain basically unchanged. A relatively new paradigm that has emerged is that of value-based pricing. According to the paradigm, the role of pricing is to proactively alter the buyer's willingness to pay by understanding and leveraging the benefits sought by the buyer1. This is in contrast with customer-driven pricing approaches based on reacting to the customers stated pay willingness. For example, consider a salesman who practices negotiated pricing. By educating his clients that price will come down if the proper pressure is applied, he may find himself compromising the value of the offering by selling at a price that is too low. However, if he can identify the benefits sought by his customers, and understand how his offerings satisfy those customer needs relative to the competition, a better strategy can be developed. Any price reductions should come through commensurate reductions in the benefits offered. If the salesman has done a good job of identifying the benefits offered to his clients relative to the competition, and has adequately priced his offering, the buyer should find the price to be acceptable and attractive compared to the available alternatives.

The Value Model

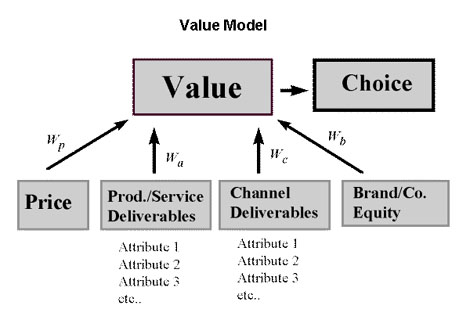

A variety of methods are used in practice to determine the value consumers place on different product/service features. Consider the following conceptual model for the value components of any product or service offering:

|

As depicted in the figure, the overall value of an offering to any one buyer is derived from constituent utility components, or part-worths, from the price, product/service features or deliverables, channel deliverables, and brand equity. In this simplified figure the individual utilities are represented by the Weights(W's). In fact, a W may represent the sum of an entire set of part-worths representing individual attributes. The individual part-worths comprise the total value or total utility of an offering, and are therefore directly related to the likelihood of purchase, or choice. For example, suppose a consumer is considering the purchase of a laptop computer. A particular laptop will have utilities associated with the price, processor speed, hard drive capacity, access memory, brand name, channel, etc. Note that each laptop has a unique set of utilities for each individual in the market.

Measuring Value

Measuring the value of the different components is critical in determining willingness to pay and being able to successfully employ value-based pricing. Measurements based on observed marketplace behavior can be utilized. However, such measurements are limited in that only existing product/service characteristics can be measured. In addition, observational data does not involve controls. Hence it is often difficult to adequately measure the separate part-worth components. If laptops with large hard drive capacities tend to also have fast processor speeds, it is difficult to determine which might be more influential. External factors can also create problems with observational investigations. Poor sales of a new line extension might be more attributable to problems with distribution and product availability or certain economic conditions during the introduction period than to any inherent problems with the new offering. Finally, using the marketplace to test price elasticity might hurt your product's equity.

An effective way to obtain information about the individual value components is through the use of designed experiments. Studies can be designed to insure that separate value components can be precisely estimated. In addition, experiments can accommodate new brands, features, prices, and channels that currently do not exist. However, the construction of experimental test sites and product prototypes can be prohibitively expensive.

Some early survey measurement methods attempted to obtain product/service value information by asking for attitudinal ratings for the separate components. For example, on a 0 to 10 importance scale, how important is brand, price, processor speed, etc. Unfortunately, the resulting ratings are often highly skewed, with most, if not all features receiving high ratings. An alternative approach is to use conjoint measurement methods in conjunction with experimental designs. As the name indicates, conjoint measurements have respondents consider the constituent attributes jointly. Respondents express preferences by ranking or rating product/service profiles. While a profile could be an actual product/service, in practice it is typically a verbal or pictorial representation. The actual selection of profiles to show respondents (in terms of profile composition and number of profiles) is determined by an experimental design that allows independent estimation of each value. By having respondents evaluate and compare profiles, they are forced to make tradeoffs among the constituent features as must be done in the actual marketplace. This information is used to derive much more accurate estimates of the feature part-worths than traditional methods.

A more recent development has been the use of choice-based conjoint methodologies. Unlike the traditional ranking or ratings of profiles, choice-based methods present an entire set of product/service profiles and ask respondents to make a choice. Typically, a number of choice sets are presented to each respondent. The composition of the choice sets is determined based upon an appropriate experimental design. Choice-based methods have the advantage of a respondent task that more closely resembles the actual shopping experience. Product/service profiles are evaluated in the context of a competitive set. In addition, a "choose none" option can be incorporated in each set. Choice-based methods produce part-worths for the product/service features based upon actual choice data rather than preference based rankings or ratings that are associated with conjoint models.

Using parameters estimated in discrete choice, a market response simulator can be developed to estimate market share. This computer-based interactive tool can provide rather precise information on the impact on market share based on changing prices, changing existing product/service offerings, as well as the introduction of new product/service offerings - all measured in a competitive marketplace. If experimental designs incorporate changes in competitive offerings, then the market response simulator can additionally provide management the ability to test their strategies against competitive responses. For example, it is possible to estimate how much additional price, if any, the market would be willing to pay for proposed enhancements in processor speed, disk capacity, etc. by observing share estimate changes in the simulator for the associated changes in the laptop offering.

Segmentation

As part of choice based designed experiments, very rich data associated with each respondent's value equation can be used to identify behavior-based segments. In traditional discrete choice experiments all respondent's choice outcomes are combined to build an overall model. To more precisely estimate demand and price sensitivity, all respondents are grouped into segments based on their price, brand, feature and channel sensitivities and models are developed for each segment. These segment level models are still robust enough to estimate a highly dynamic marketplace, and at the same time minimize the impact of washing out unique market behavior. In addition, these behavior-based segments can be used to better identify optimal strategies targeted toward key market and channel opportunities. This is done through the optimization capabilities within the market response simulators by basing the analysis to just the key segments.

Extending Value-Based Pricing through Profitability Analysis

Value modeling is a useful methodology that provides necessary product/service benefits information critical to successful value-based pricing. However, while value-based pricing is useful in leveraging buyer's willingness to pay, it alone is insufficient. The missing ingredients are the firm's production, advertising and promotion costs. A value-based solution may direct the development of a product at a particular price that the company is unable to produce profitably, or the channel may not be willing to accept. Market share simulators should be augmented with cost information and channel margins so that company profitability rather than just market share numbers are optimized. In addition, profitability optimizations can be programmed to automatically produce charts revealing profit maximizing price and feature settings, and also the sensitivity of the optimal solution to deviations from the optimal settings.

An Example

To illustrate some of the benefits of value-based pricing, consider an actual study that was done recently for a utility company that wanted to provide a home warranty offering to their customers. In this study the utility company wanted to determine the demand, price sensitivity and the impact of existing competitive offerings for different home warranty packages targeted to their current customers. The relevant attributes that need to be analyzed were, features of the different offerings, provider, price and a component of price which was the per call deductible associated with the warranty plan.

The specific offerings being considered were warranty packages covering:

- Package 1: Refrigerator, range or built-in oven & cooktop, built-in dish-washer, built-in microwave, washer, dryer, & water heater

- Package 2: Package 1 coverage plus up to 2 heating/air conditioning systems

- Package 3: Packages 1 and 2 coverage, plus wiring & plumbing coverage

The competitive set was:

- Utility company, Visa, General Electric and Sears

Price was allowed to vary plus or minus 30% off the existing/proposed pricing

There were 3 levels of deductibles; $50, $25 and $0, which were tied to different retail selling prices

Top line overall results indicated that the utility company could get about a 21% share of the market at competitive prices and that a $50 deductible was the most desirable. In addition, through exploring price sensitivity analysis, even though demand significantly increased as price was lowered for the utility company their profit contribution did not increase. However, by raising prices for certain offerings, projected contribution increased by almost 20%. The segmentation, based on respondent level values, identified 4 segments, of which one was much more inclined to buy from the utility company. Through careful analysis of this segment's values, 60% of this segment preferred a $0 deductible plan, versus a 30% preference for the overall sample. Using this key information, a $0 deductible plan was added and the overall contribution for the utility company increased by over 50% as compared with a plan that did not offer a $0 deductible option. In addition the price sensitivity of this group was lower than other groups and additional contribution through specific price increases for the small product offering further increased projected contribution for the utility company.

Summary

Value-based pricing is an important conceptual approach that leverages the benefits of the product/service offering in order to match the buyer's willingness to pay with the value received. Effective application of this approach requires accurate value model estimates of the type provided by experimentally designed studies. However, the ultimate strategic decisions need to integrate the firm's costs, existing market conditions, advertising, and promotion strategies in order to develop comprehensive value-based pricing strategies.

|